Space Search + Shortlist

Targeted market sweep + off-market outreach. You get a shortlist that actually fits.

- Tour plan + scoring

- Site constraints + access

- IOS / yard requirements

Space search, leverage strategy, negotiations, and execution—built for operators who don’t have time to babysit a deal.

Industrial tenant representation with clean execution—without the runaround.

Targeted market sweep + off-market outreach. You get a shortlist that actually fits.

We build leverage before negotiations—so you’re not guessing.

LOI → lease → signature with tight control over timelines and redlines.

Simple, repeatable, and built to cut decision time in half.

Use, SF, docks/drive-ins, clear height, power, yard, budget, and timeline.

We pull everything that fits and call ownership directly to uncover quiet inventory.

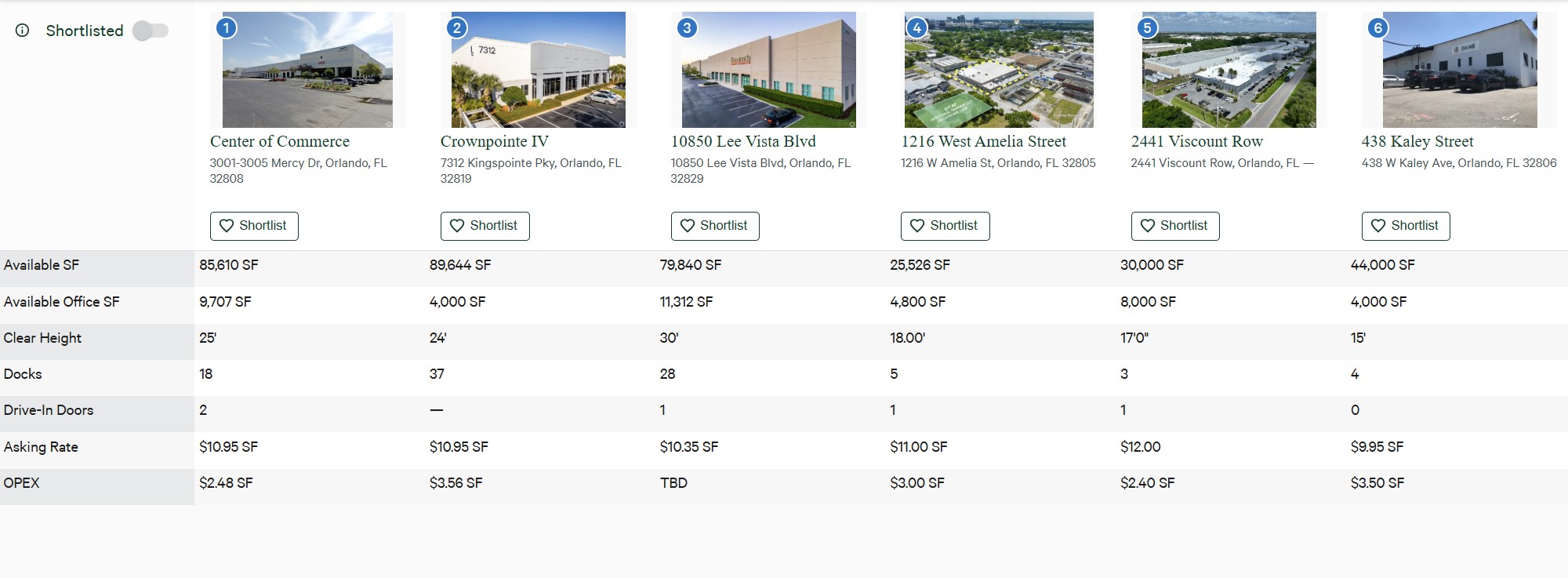

You get a ranked shortlist with clear tradeoffs so the right building wins quickly.

We anchor terms, protect flexibility, and push concessions intelligently.

Redlines, COI requirements, deadlines, and coordination to the finish line.

Key market indicators we use when advising tenants on timing, leverage, and deal structure.

These figures inform how we approach leverage, concessions, and lease timing for our tenant clients.

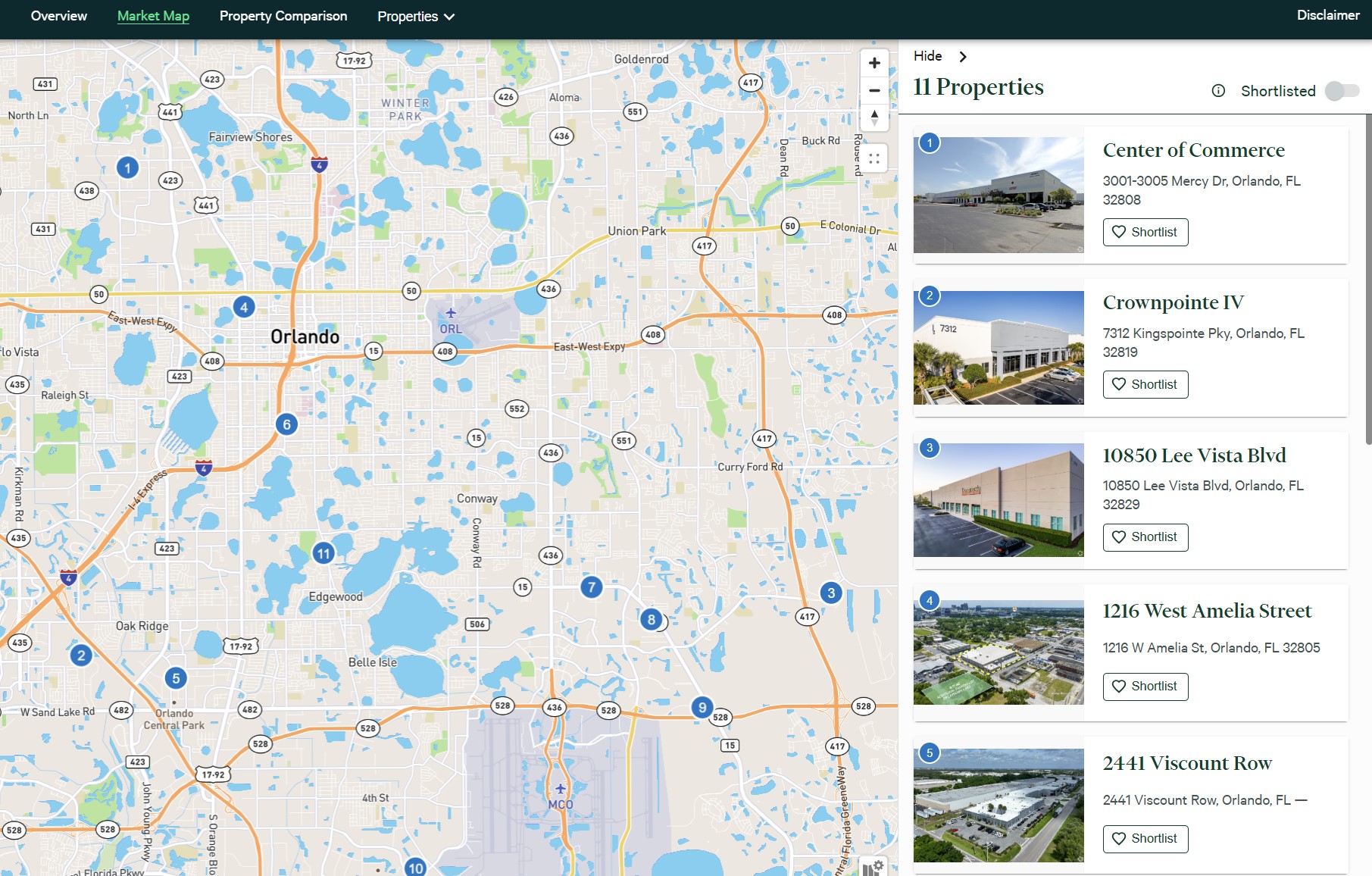

Visual tools we provide to speed up decisions and reduce surprises.

Estimate monthly rent using annual $/SF rates. Formula: (SF × (Base + OPEX)) ÷ 12

If you prefer, send requirements directly and we’ll build the shortlist.

Jose Rivera

Email: jose.rivera1@cbre.com

Phone: (407) 404-5067